< Back Helpful Articles

What's the Difference Between a Home Equity Line of Credit (HELOC) and Refinancing?

By

ASB

April 06, 2021 |

5 min

read

Personal

Living in Hawaii isn’t cheap, which makes purchasing a home in Hawaii a huge financial milestone for many. In addition to making your most valuable memories in your dream home, you can also use your home’s equity to reach your next financial goals like renovating your dream kitchen or paying for your keiki’s education. Read on for more information about how you can achieve your next financial dreams through a Home Equity Line of Credit (HELOC) or a Cash-Out Refinance.

What is Home Equity?

Your home equity is simply the value of your home that you own. You can find your home equity value by taking the current value of your home and subtracting anything you currently owe on it.

For example, if your home is currently worth $700,000 and your remaining mortgage balance is $300,000, your home equity is $400,000. Most banks will allow you to draw from your available equity up to 80% of your home’s value. In this example, you might be able to access $260,000.

Your home equity grows consistently over time as you pay off your mortgage. Each mortgage payment lowers your principal balance and increases your home’s equity. This can also increase if the value of your home increases. For instance, if you make renovations to your home, the value of your home could go up.

What's a HELOC?

A Home Equity Line of Credit, known as a HELOC, is a revolving line of credit based on the value of your home’s equity and works similarly to a credit card. If you qualify, you’ll receive a credit limit based on your credit worthiness, credit limit request and available home equity. You may receive a payment card that’s used to directly access funds from your HELOC.

HELOCs usually come with a variable interest rate based on an index, which means that if the index rate goes up or down, the interest rate on your HELOC will adjust, too. ASB also provides a fixed rate option for our HELOCs so you can lock in a low fixed rate on a portion or all of your outstanding HELOC balance.

You won’t pay interest on your HELOC until you borrow money from the line of credit. Then, you’ll only pay interest on the money you borrow. For example, if you have a $10,000 HELOC and withdraw $3,000 to pay for kitchen updates, you’ll only pay interest on the $3,000 you borrowed. You’re also able to borrow the remaining available balance of $7,000 if you need it.

Just like a credit card, you can access your credit as much as you need as long as you’re able to pay off the balance to make your credit available again (revolving line of credit). For example, if you borrow $10,000 from your HELOC and your line of credit limit is also $10,000, you will not be able to borrow from your HELOC account again until you pay off all or part of the $10,000 you borrowed, plus interest.

If you are unsure how much money you’ll need, a HELOC gives you flexibility to draw funds (borrow) as needed over a 10 year draw period. HELOCs generally have a quicker loan application process with limited closing costs, and can also be used as your second mortgage.

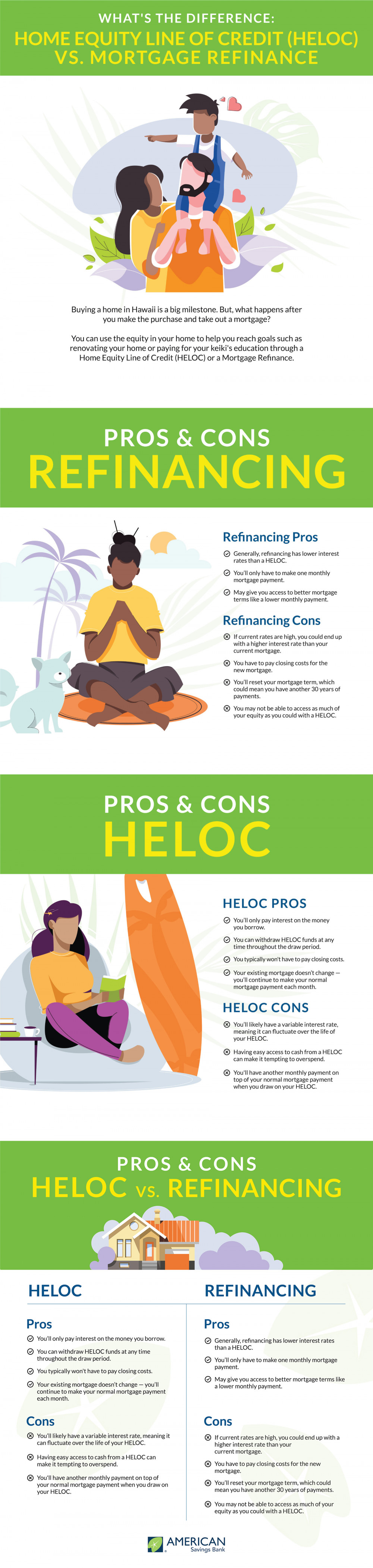

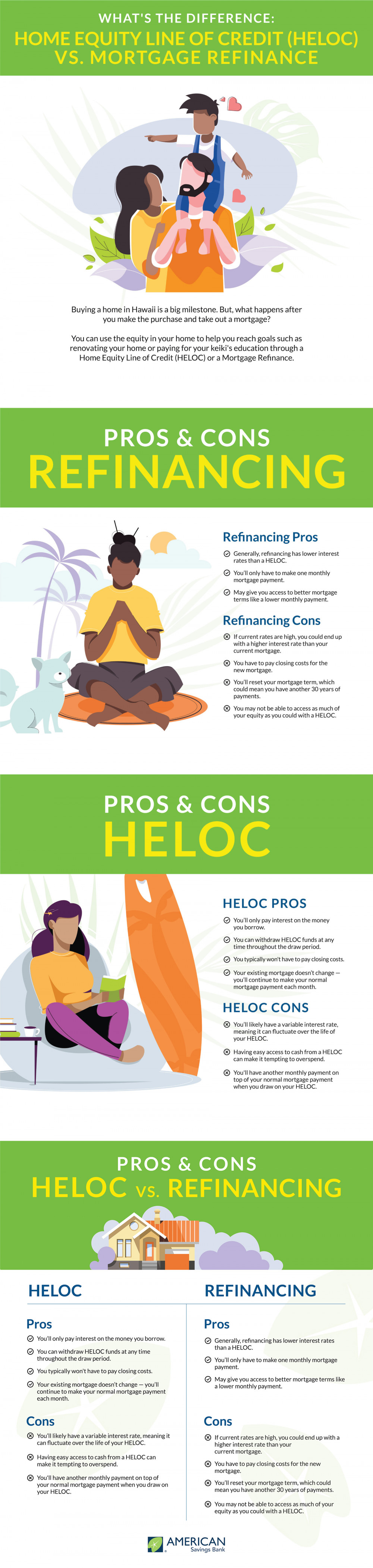

HELOC Pros

You’ll only pay interest on the money you borrow

You can withdraw HELOC funds at any time throughout the draw period

You typically won’t have to pay closing costs

Your existing mortgage doesn’t change — you’ll continue to make your normal mortgage payment each month

HELOC Cons

You’ll likely have a variable interest rate, meaning it can fluctuate over the life of your HELOC

Having easy access to cash from a HELOC can make it tempting to overspend

You’ll have another monthly payment on top of your normal mortgage payment when you draw on your HELOC

What's a Refinance?

You might want to consider a cash-out refinance if you don’t want to take out an extra loan on your home. Refinancing your mortgage works by replacing your current 1st mortgage loan with a completely new 1st mortgage loan. Funds from the new mortgage loan are used to pay off the remaining balance of your existing home loan. The new mortgage loan then becomes your regular loan payment. Refinancing can help you to consolidate high interest credit card and loan debts, lower your mortgage loan payment or take advantage of lower interest rates. Refinance can also help you pay off your loan quicker if you switch to a shorter-term loan such as a 15-year mortgage loan.

Cash-out refinances take out a new 1st mortgage loan that’s more than your current loan balance but less than the value of your home. The difference between your home’s value and your existing mortgage loan balance becomes cash you can use for things like home renovations or paying off other debt.

For example, let’s say your home is currently valued at $800,000. If your remaining mortgage loan balance is $300,000 and you have $500,000 of equity in the home, a cash-out refinance accesses that equity by taking out a new loan that’s more than the loan balance but up to 80% of your home’s value. In this example, you get a cash-out refinance mortgage for $640,000 . You use the loan funds to pay off the remaining $300,000 from your existing mortgage and receive the additional $340,000 of loan funds as a lump-sum.

Refinancing Pros

Generally, refinancing has lower interest rates than a HELOC

You’ll only have to make one monthly mortgage payment

May give you access to better mortgage terms like a lower monthly payment

Refinancing Cons

If current rates are high, you could end up with a higher interest rate than your current mortgage

You have to pay closing costs for the new mortgage

You’ll reset your mortgage term, which could mean you have another 30 years of payments

You may not be able to access as much of your equity as you could with a HELOC

When is the best time to get a HELOC or refinance?

If the pandemic has taught us anything, it’s that we have to be prepared for uncertainty. We also don’t know how long this low rate environment will last, so taking advantage of it now could help you in the long run. If you got your current mortgage at a high interest rate, now could be a great time to use a HELOC or refinance to reduce your rate. In addition, the application process may be even easier that you previously experienced. Mortgage lenders like ASB now offer online mortgage applications, which allows you to apply from the comfort of your own home. This makes the process more safe, secure and convenient. Of course, you can still apply in person with a loan officer, too.

How to access the equity in your home

A great way to get started is to take a step back and look at your current finances – your existing mortgage loan, your savings and your financial goals. Do you have high interest debt? Do you have plans in the near future? Kids going to school?

As mortgage loan rates rise and fall, it impacts how refinance rates compare to HELOC rates. Some things to consider are:

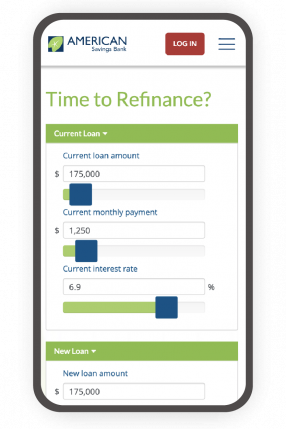

You can also use a calculator to determine your home equity and how to best use it. At ASB, we offer calculators on everything from comparing mortgages, analyzing rates and determining if it’s time to refinance.

Choosing between a HELOC and cash-out refinance can feel overwhelming. Whether you want to update your kitchen or consolidate debt, the equity in your home could help you cover the cost. We recommend talking with one of our experienced ASB Home Loan Officers to see which option meets your needs the most.