Help and Support for Your New Business

Back to Business Resource Center >

There's a lot of on-going help available for new businesses in Hawaii – including government departments, financial institutions, business associations and non-profit organizations.

Be sure to explore different resources to find what you need to support your business growth at every stage. Ask other business owners for their recommendations on who they have accessed as well.

Professionals

There are a range of services that you can access, and who you choose depends on your own capabilities and type of business. If possible, choose advisors who have several other clients in your industry because they can often pass along that experience to your benefit. Even better if they specialize in your specific business sector.

Examples include:

- Accountant - This is your go-to person for advice on major financial decisions, tax filing, tax planning, and, eventually, preparing for business succession. While an accountant will charge for their services and advice, it’s usually worth the investment.

- Lawyer - This is how you prevent legal hassles down the road. Your lawyer can set up a company for you, draft a sales agreement to use with customers, review your website for legal issues, create contracts for your employees and help you to protect your intellectual property.

- Business advisors and coaches - A business advisor is someone who will answer general business questions for you. A business coach will work with you to set business goals and encourage you to achieve them. Ask your colleagues for a recommendation.

- Industry groups - You may want to join an association that represents your industry to stay on top of industry news and regulations, and to connect with your peers. Industry groups also provide professional development and learning opportunities for members.

- Chamber of Commerce - Your local Chamber will host business networking events, seminars, workshops, award dinners and other activities designed to help business owners learn and connect with each other. Check out the Chamber of Commerce Hawaii to explore membership.

- Management consultants - These are typically category-specific advisors brought in to help you address a particular challenge.

- Business Mentors - A business mentor may be an experienced businessperson you’ve recruited to guide you through the process of starting and growing your business. You may find a business mentor through your local business media, Chamber of Commerce, business support group or professional network. Consider signing a mentor agreement to commit both parties to the process, establish the time commitment and define responsibilities.

- The National Federation of Independent Business (NFIB) - This member organization offers a wide range of business services including advice, financial expertise, support and a powerful voice in government.

- Business banker - Remember that your banker will have a wide range of business experience that you can call on to help when starting your business.

Hawaii Small Business Development Center (SBDC)

A helpful resource for new and existing small business owners, your local Small Business Development Center provides business support.

Key support elements include:

- Advice from business advisors on various business topics, including marketing, finance, human resources and operations.

- Research and analysis services to help you conduct market research, feasibility studies, business development strategies and industry studies.

- Workshops and seminars – The Hawaii SBDC offers a regular schedule of affordable workshops, conferences, and special events designed to teach practical, hands-on small business management skills.

There are several SBDC locations throughout Hawaii. Visit the Hawaii Small Business Development Center website for more details.

SCORE

Funded by the US Government, SCORE is a non-profit dedicated to helping small businesses by offering free mentoring, workshops, events and content to help you start and grow your business. Other resources include:

- A resource library full of great links to content rich websites.

- SCORE Women which provides support education and fellowship for female entrepreneurs.

- A range of success stories profiling local businesses that have succeeded.

Useful business websites

-

www.sba.gov/offices/district/hi/honolulu - The US Small Business Administration (SBA) offers business counseling, learning opportunities, business resources and funding programs to support new and existing small businesses.

-

https://ambergrantsforwomen.com/free-grant-tips-hawaii/ - Business women from Hawaii are eligible for an Amber Grant to help fund their enterprise.

-

www.usgrants.org/hawaii/small-business-grants - US Grants is a website directory of small business funding available to entrepreneurs in Hawaii and other states.

-

http://cca.hawaii.gov/breg/ - The Business Registration Branch of the Department of Commerce and Consumer Affairs is the place to go to register your corporation, limited liability company, general partnership, limited liability partnership or limited liability limited partnership in Hawaii. The Branch also registers trade names, trademarks and service marks.

-

www.irs.gov/businesses - The Internal Revenue Service (IRS) website provides tax information for businesses, including filing taxes, record keeping responsibilities, hiring employees and opening business tax accounts.

Summary

Spend some time online to research these resources and discover others. Check out local business organizations and services available to help your new enterprise thrive in Hawaii. Read trusted business publications for a source of growth strategies, business tips and inspiration.

Next steps

- Contact one of our friendly Business Relationship Managers to see how we can help your business.

- Before you join any association or group, ask to attend as a guest to see if the organization can bring value to you and your business.

- Ask experienced small business owners to recommend resources they used to get started.

- Attend local business conferences, trade shows and franchise shows to discover additional resources to support your business journey and build your business network.

- Use social media to follow trusted business advisors, organizations and associations.

Get Started

Products Needed to Start

BUSINESS LOAN CALCULATOR

Protecting your business from theft and fraud

Back to Business Resource Center >

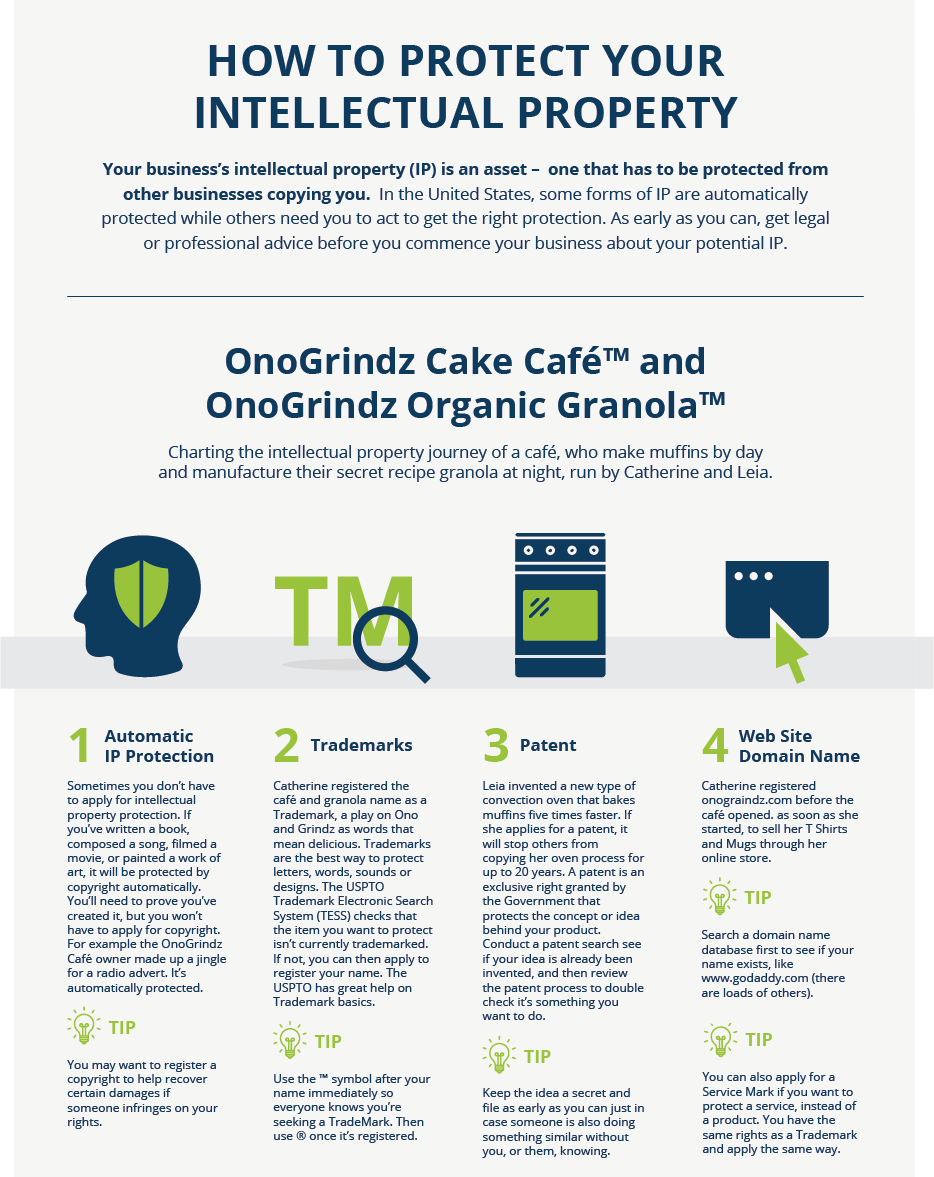

There are a number of risks that you’ll face in business – from employee theft to a competitor using your intellectual property. It’s your responsibility to safeguard your business from anything that may impact your survival and growth.

Like most things in business, prevention is the best cure – a little planning now could save you a significant financial cost in the future. Review the following list of some of the common issues faced by businesses.

Staff theft and fraud

To safeguard yourself and your business from being affected by employee misconduct it’s important to take proactive steps to ensure opportunities for fraud are limited. A written policy of accountability and robust cash-handling systems will reduce the risk of theft or fraud.

-

Stealing products, or stealing and selling to others at a lower cost.

-

Stealing work time (such as an employee consistently leaving early, or wasting time at work and keeping other employees from getting their work done).

-

Excessive and unauthorized employee travel costs and expenses.

-

Employees filling up their personal car with gas using the company-issued fuel card.

Solutions to protect your business

-

Outline specifically what’s considered theft in any employment agreements with staff and what is deemed misconduct. Taking one piece of photocopy paper home may be ok, but taking a ream of paper may not be.

-

Train your managers to spot theft – a vigilant manager is usually the first and immediate line of defence against employee misconduct.

-

Regardless of who it is (even a key employee) you must be seen to take action, otherwise you’re viewed as condoning the action and it becomes an accepted practice.

-

Limit the number of employees assigned a business credit card set card spending limits.

-

Set up stock control software and systems to track all products in and out of inventory.

-

Require two people to sign products in and out of inventory management systems.

-

Remove cash handling by going online for all receipts and asking business customers to pay online.

-

Set up stock control software and systems to track all products in and out.

-

Deposit cash to your business account at least daily, if not more often depending on the amount of cash you carry.

-

Pay for expenses via a business credit card rather than using petty cash.

Customer payments fraud

Customer payments fraud is simply any kind of customer deception that leaves you paying for losses out of pocket.

-

Check fraud - A person commits fraud by writing several checks in a short period, knowing there are insufficient funds to cover all of them.

-

Credit card fraud - When someone illegally uses another individual’s credit card or uses a stolen card.

-

Counterfeiting - A person could attempt to pass counterfeit cash or counterfeit checks at your business.

Solutions

-

Perform credit and security checks on any credit you offer to other businesses, and don’t forget to check the debt history of the owners.

-

Only accept advance payments, or at least a deposit before commencing work to cover your material costs. If it’s possible and relevant, ask for progress payments on a regular basis so you’re being paid as you go.

-

Do not allow employees to sell to friends and family (who could be receiving large unauthorized discounts).

-

Educate your staff on common fraud techniques and how they can spot them. These include a customer having ‘forgot’ their photo ID so you cannot check their card details, or buying a small amount of product with cash (to trust them) then buying a large volume with a stolen credit card.

-

Allow only a select few employees to accept payments from customers, and regularly change these employees so it’s not the same person each time.

-

If it’s relevant only accept electronic payments and do not accept checks (if bad checks are an issue for your type of business).

Theft of ideas or brand

-

Copyright – protection for original works of authorship, including literary, dramatic, musical, and artistic works.

-

Trademarks – protection for words, phrases, symbols or designs that identifies the source of the goods or services.

-

Patents – protection for inventions or discoveries .

Theft of intellectual assets

-

Sign a Non-Disclosure Agreement with key clients to reduce the chance they will tell everyone how you do business.

-

Draft confidentiality agreements and restraint of trade clauses with staff to deter them from taking your trade secrets to a competitor if they leave.

-

Keep your best ideas to yourself.

Next Steps

- Identify the key risks in your business.

- Involve employees to detect any risks they may see.

- Develop a plan to mitigate the key risks to reduce the chance of them happening.

- Make sure implement these risk reduction tactics as part of your operating procedures.

Get Started

Products Needed to Start

BUSINESS LOAN CALCULATOR

Where to Get Funding to Start Your Business

Back to Business Resource Center >

Once you have a solid business plan, including how much money you need to start your business, one of the next steps is to figure out funding sources to launch your business. Here are ideas to consider to finance start-up costs.

Personal Savings

Pulling from personal savings is a common way to invest in your business. You won’t incur any borrowing costs if you can invest some of your own money. You can also consider:

- Look at what you currently own that you could sell to raise funds for your business, such as vehicles, furniture, even sports equipment. Selling personal assets can be an effective way to increase your cash base.

- Cut personal expenses or find other ways to raise the cash you need, such as picking up part-time work.

Funds From Friends and Family

Money from friends and family is a common way of raising the funds you need. But remember, if your business fails, borrowed money from friends or family might sour personal relationships. Be sure to put any financial agreement with a friend or family member down in writing. Clarify when the money is to be repaid, along with any interest.

Borrow What You Need

There could be assets or set-up costs that you can delay paying by borrowing equipment or machinery or working with existing businesses to use any of their spare capacity until your business is big enough to buy your own.

Money From the Bank

You can borrow money from the bank to get your business started. Bank financing comes in several options. You can take out a loan and pay it back over time, an overdraft facility that lets you dip in and out of debt when you need it, finance equipment or apply for a business credit or debit card for short-term expenses. Talk to an American Savings Bank Business Relationship Manager about our range of business lending solutions.

Before you apply for business financing, it’s important to have all your financial information in hand:

- Purpose: What you want to do with the cash.

- Funding sources: How much you think you’ll need to borrow and how much you’re contributing yourself.

- Loan security: what you’ll use to secure repayment of the loan, if anything.

- Repayment plans: How you intend to repay the loan and the schedule of repayments in your cash flow.

- Existing debt: If you’ve got any other debt that may impact on your ability to repay.

Other Sources

There are several other ways to fund your business, such as outside investors, crowdfunding and government subsidies that can help provide essential funding to launch your business. Here’s some information on each.

Outside Investors

You may find people you know who want to invest in your business. Often called “angel investors,” these people are usually business owners in search of investment opportunities with promising businesses. In return, they usually expect a share in your business, a percentage return on the money they’ve given you or both.

- For more information, check out the Angel Capital Association and other groups such as www.hawaiiangels.org.

Venture capital companies are professionally run businesses that look to invest in companies they anticipate will be sold to the public, or to a larger company, at a high rate of return. If your business is in a fast-growing industry with a large market potential, you may just catch the eye of an investor.

- The National Venture Capital Association (NVCA) is a good place to start.

Crowdfunding

Crowdfunding allows you to profile your business and attract investment—or loans—from a range of different people who wouldn’t normally be eligible to invest in new businesses without a prospectus. You receive investment in your business through a crowdfunding platform hosted online, usually in return for shareholding.

- Kickstarter is a good example of how this works.

Government grants and subsidies

The government can sometimes provide funds for businesses if you qualify. This includes loans, grants, export assistance and other initiatives. The Hawaii.gov website offers information about different grants and financing options that may be available to your business. The SBA offers loan programs to small business owners. If you are interested in applying, be sure to visit American Savings Bank, as we are an accredited SBA loan provider.

Summary

Every dollar you can save when starting your business is one more dollar you won’t have to raise. Unnecessary overhead costs are the last thing you want to deal with, so nonessential expenses should be cut from your budget. Work with your accountant to see where you can save money on start-up expenses.

Next Steps

- Be careful not to over-estimate your start-up expenses and under-estimate your revenue during the first year. If the reverse happens and the business succeeds early on, you will be in a favourable financial position.

- Use the start-up costs calculator at American Savings Bank to estimate how much money you’ll need to get your business up and running, and then identify your possible cash gap.

- Contact one of our American Savings Bank Business Relationship Managers to see how we can help fund your business.

Get Started

Products Needed to Start

BUSINESS LOAN CALCULATOR

Ways to Manage Cash Flow

Back to Business Resource Center >

A business can survive for a short time without sales or profits. But your business needs cash to pay bills and to continue operating. Since cash flow issues can cripple a business, the more warning you have of peaks and troughs, and the more time you have to deal with them.

It may sound obvious, but if you never run out of cash and can pay your bills, you’ll likely never go out of business.

Watch for Early Warnings

From budgeting to early warning systems, there are many ways to track your money. Consider the following:

Use Accounting and Cash Flow Software

Accounting software makes it easier to prepare budgets and forecasts; you can access information coming straight from your bank account. You can also quickly update a monthly cash flow forecast and make “what if” calculations.

Prepare Realistic Cash Flow Forecasts

If you prepare and update monthly cash flow forecasts showing what cash you expect to come in and what cash will go out, you should know in advance when you might run into problems. Being able to spot any cash flow red flags in advance will give you time to correct any problems and make necessary adjustments.

Monitor Key Figures

Decide which profit warning signs hint at a deteriorating cash situation. Comparing short term performance measures to the long-term cash forecast can quickly reveal if sales and profits are going to plan. For example, you could monitor every week or month the following:

- Watch your gross profit margin to ensure it’s not slipping. This is often caused by paying too much for raw materials or products.

- See if you or your staff are offering discounts that are too high to beat competitors.

- See if raw materials or inventory levels are slowly building up. This can signal either a slowdown of sales or products that customers aren’t interested in buying.

- See if customers are exceeding their credit limits and are paying their invoices too late.

Grow at the Pace You Can Afford

Before taking on any large financial commitment, including major new orders or equipment purchases, check that you will have sufficient cash flow to pay. More business may seem attractive, but you don’t want to run out of cash to fund this growth.

Non-Financial Red Flag Warnings

Develop red flag systems on less obvious signals to warn you, such as:

- New lead queries are falling, or customers are taking longer to confirm a sale.

- A substantial or loyal customer stops buying from you or they’ve switched to your competitor.

- Fewer phone queries or less web traffic or fewer new followers on social media.

- A decrease in local foot traffic, which can lead to long term lower sales.

- A shift in consumer behavior.

- A new competitor opens nearby and is targeting your customers.

How to Reduce the Chance Your Business Runs Out of Money

There are a number of ways to reduce the chance of your business running out of funds. The most obvious tactic is to have enough cash reserves to be able to ride out any fluctuation or downturn. Every business should always be looking to implement the following:

Get Progress Payments

When negotiating contracts with customers, make generating cash flow one of your primary objectives by asking for deposits or progress payments. Staged payments improve your cash flow and protect you from total loss if a customer fails to pay.

Invoice Immediately

Improve your sales and profit margins by invoicing on the same day. Consider collecting payments using mobile payment options immediately after any work is complete. With larger customers, ensure you have purchase order numbers in advance so you can enter the customer’s payment cycle faster. If appropriate, follow up and confirm the invoice details and due date.

Have Strict Credit Control

Efficient credit control systems speed up cash collection and reduce bad debt, saving time and showing lenders and investors that you run your business professionally. Consider debt collection agencies or lawyers specializing in debt collection can be effective in difficult credit situations.

- Run a credit check on all customers before extending credit terms, even if it’s with a well-known business.

- Control how much credit you provide and with whom you provide credit. Consider using a credit scoring system and set appropriate credit limits for all customers so no one can put your business at risk by owing you substantial amounts of cash.

- Ask for deposits and partial payments before you start any work or supply products.

- Monitor and follow up on late payments systematically by tracking down the largest debtors first.

- If charging interest on late payments, state it on your terms of trade and have the customer sign the agreement.

Limit Expenditure

Regularly ask suppliers to renegotiate. Consider carefully when purchasing capital equipment or any other large-scale purchases. Ask yourself whether you really need the equipment, or if it can be borrowed, leased or rented instead.

Accurate Stock Control

Good stock control can release substantial sums of money as it prevents you from having large amounts of money tied up in inventory or raw materials. Use inventory software to hold just enough stock to service customers on an on-going basis.

Summary

It is important to be aware that even if you are profitable and sales are increasing, a lack of cash flow can still significantly harm your business. Create contingency plans, including how much additional working capital you’ll need to fund any increase in sales and the associated costs of job growth. Have cash in reserve or a plan to access capital to remain in business. Finally, monitor that you’re not withdrawing too much capital so that it puts your business at risk.

Next steps

- Contact one of our Business Relationship Managers to see how we can help your business grow.

- Predict any cash flow issues in advance with a cash flow template or your accounting software.

- Conduct an audit of your business cash position and make a list of actions you can take to reduce any cash stress.

- Build a cash reserve over time to weather any short-term crisis.

Get Started

Products to Maintain your Established Business

BUSINESS LOAN CALCULATOR

Developing New Products and Services

Markets are dynamic and constantly evolving, no matter how excellent your current products or services. Therefore, it’s useful to regularly redevelop, replace, upgrade or update your products and services to continue growing your business. Here are some practical methods to uncover a potential new product or service in your business.

Seek Inspiration

To find new product or service ideas try the following:

- Attend trade shows to see what similar businesses are doing. Spotting new trends and products is a great way to come up with new products or services.

- Network by attending business events and conferences. It’s an excellent opportunity to learn about developments in your industry and to stay connected with your peers.

- Search online all the different industries or key words that are relevant to your business and see what other businesses are doing.

- Look at research or government support websites for businesses or industries similar to yours. Often governments profile high growth businesses and there may be ideas that inspire you.

- Look on other US State support sites such as invest.hawaii.gov as just one example. Some have business registries to search for similar businesses.

- Engage on social media platforms and channels by following relevant feeds pages and groups. They are ways to stay up-to-date with what’s happening in your industry.

- Third party ecommerce platforms have a wealth of ideas to spark a new thought or variation on what you’re doing.

- Search for any published university or other industry research findings in case you can apply them to your business.

Finally, contact your customers and ask them what else they need, what are their issues and problems that you can help to solve.

Signs that the idea could work

While a good idea has no guarantee of success, a bad idea will most certainly fail. Here are some signs your new idea could work:

- You can sell it at the price or volume necessary to make a profit. Even the best idea ever will not last if it costs more to produce or deliver than you can sell it for. Find out early the likely cost to create or offer, and if there is a margin to be made.

- Your idea cannot be easily copied. This prevents competitors from quickly copying your idea once you’ve launched.

- You have market power, a great distribution channel and an established brand. This will help customers trust that the new product or service will work, as they already know and understand your business.

- Your current customers have been asking for it or are involved in the design phase.

- Employees are convinced your new ideas will work. They will often have a clearer insight into what customers are asking for.

- You have the capacity and capability to produce any new product or service and if you need additional equipment, facilities or people to do so.

Project manage the process

Since product development involves time, labor and finance, it’s important to plan carefully in advance. Minimize your risk by applying some sound management techniques to your planning process. Create a team with the skills needed to make the project a success and choose a team leader.

Every new product needs a champion to lead the team. Incorporate the following:

- You or one of your key employees should be appointed as a project manager, so that there’s a clear understanding of how the new product or service will fit in with the overall capabilities of the business, as well as regularly measuring and reporting on progress.

- Give the team leader the authority to run the project—within an agreed budget and timetable—with the responsibility of reporting progress to you at agreed milestones.

- Be customer centered and work closely with your best customers to help develop and fine-tune any idea.

- Protect any innovation with either intellectual property protection, such as patent, trademark or copyright, or keep it as an intellectual asset (meaning don’t tell anyone what you’re doing).

Test the new product

Once a prototype of the new product has been produced, or a new service decided on, it needs to be tested. A soft launch done locally with a few customers is a smart way to test the waters and gather feedback. You can find out what customers think and tweak your new idea, if needed.

Testing will reduce the major risks early so you can decide if it’s worth the potential reward. Minimize the risk by:

- Establishing the likely volume of sales and the marketing and sales cost of achieving each sale to get a satisfactory return on your investment.

- Determining if your target market and industry is growing and will be able to absorb a new product or service.

- Identifying any competing products already in the market and ensuring your business offers something different and unique.

Summary

Successful businesses are those that are continually looking for ways to innovate. This is an essential component for achieving growth. Whether it’s a new product or service, or one you’ve come up with that’s designed to complement existing ones, make sure you consider all the above carefully, as this will help maximize your chances of success.

Next steps

- Contact one of our Business Relationship Managers to see how we can help your business grow.

- Look at your existing product and service lineup to review what could be improved or modified for different application.

- Conduct a focus group to ask customers what they like about your products or services and what could be improved. Ask them what else they’d like to buy from your business.

- Stay current with your marketplace by reading newspapers, magazines and online publications.

- Find ideas and inspiration by attending events featuring industry leaders.

Get Started

Products to Maintain your Established Business

BUSINESS LOAN CALCULATOR

How to Increase Margins

Back to Business Resource Center >

Increasing sales might make more profit for your business but consider increasing profit margins –especially if there is limited opportunity to increase sales.

Growing your business can be achieved by growing profit rather than sales.

First, increase prices

Increasing the price of your goods or services seems the obvious answer when trying to improve margins. And it is. Nothing will improve your margins more than a price increase (with the understanding a price increase could cause a drop in sales if you’re over-priced).

However a price increase will always improve your margin. Try:

- Increasing your prices by a very small percentage, even 1-5%, will still generate improved results.

- Using an external event (such as a new tax change, the fluctuating US$ exchange rate) to justify why you’re charging more.

- If you do face increasing costs, customers often understand the need for rises.

Price sensitivity

If you have price sensitive customers, then consider the impact on sales that a price increase may have.

There will always be a threshold where customers will switch for a lower price regardless of how great your business is, especially for products and services where customers have a fair idea of the cost.

If you do sell items that are price sensitive, keep your major products or services at competitive prices. Instead, think about increasing margins on supplementary products or services where customers are either not so familiar with the price or don’t compare you with the competition.

Second, lower the cost of supply

The other main way you can improve your margins is by lowering the cost of supply – finding ways to pay less for any of the costs associated with bringing your products or services to consumers.

To achieve lower costs, consider:

- Sourcing raw materials from a less expensive supplier if they offer the same quality. It’s easy to fall into a routine and always order from the same supplier. Consider every year (or two) to re-tender or seek new quotes from suppliers.

- Purchasing in bulk if discounts are available, you have the storage space, and you don’t stock perishables.

- Importing – if your business can get similar raw materials or products from overseas at lower cost, it’s worth looking into.

- Ensuring you take advantage of any early payment or cash payment discounts.

- Taking steps to reduce theft and wastage – make sure your inventory system is efficient and links through to sales, and there is less room for fraud.

Third, focus on larger margins

Concentrate on the products or services you sell that have the biggest margins – by selling more of these items, your business will gain more profit. Train your employees to be aware of which items have the biggest margin and are therefore best to sell if the customer is unsure. If you need to, allocate incentives or bonuses for selling high-margin items.

Likewise, begin to phase out goods that have low margins. If you’re selling plenty of them but not making much profit, it might be best to use that space or time for something more profitable.

Other options for focusing on larger margins include:

- Changing your product or service mix and giving customers more choices to buy high-margin items and fewer choices on low margins.

- Promoting items with the highest margins above those that have low margins.

Remember the 80/20 rule outlines that 80% of your profits comes from 20% of your goods or services. Make sure they are the high-margin products.

Finally, try these ideas

Target better clients

Change the customers you are targeting to ones who will spend more money or who are less price resistant. They may be quite happy to pay a higher price for what you offer.

Consider only doing business with those customers that pay on time, or in cash, or don’t always want a discount. By not having to wait for your money, you will enjoy higher margins by either paying less interest on any financing or receiving interest on spare cash.

Are there any clients that cost less to service (such as closer to your location or don’t require on-going support)? Having more of these customers will lower your overall costs and, therefore, increase your margins.

Attract new clients

You could open new locations or target new regions where customers are willing to pay a higher price. If you focus on local consumers who are price sensitive, can you find commercial or government customers who may be prepared to pay more for what you do?

Review how you work

Some businesses are able to reduce their fixed overheads, such as replacing salaried staff with part-time or contracted workers. In addition:

- Assess if any staff can work from home, possibly lowering any lease costs as you’d need less room to operate.

- It could be possible to sub-contract any non-essential manufacturing to other businesses, to save you holding fixed costs or raw materials.

- The world is increasingly a global marketplace. What else can you source cheaper than your current supplier? This could be service tasks such as accounting services, subscriptions and training.

Summary

Realizing higher margins removes some pressure from sales because it means you can sell fewer products and services, or the same amount, and return a higher profit. Get in the habit of regularly reviewing your margins to make sure they haven’t changed due to creeping input costs or sales discounts. Repeat these strategies often to keep enjoying healthy margins in your business.

Next steps

- Contact one of our friendly Business Relationship Managers to see how we can help your business.

- Ask your suppliers to re-quote prices on materials, products or services to make sure you get the best price.

- Invest in quality accounting software to accurately track your sales, expenses and margins. Review financial reports every week or month.

- Speak with your accountant to explore additional ideas to improve your margins.

- If you plan to significantly increase your prices, consider selling to existing customers at the current price and charging the increase to new customers only.

Get Started

Products Needed to Grow

BUSINESS LOAN CALCULATOR

Ways to Increase Revenue

Back to Business Resource Center >

Keep in mind that a profit increase doesn’t always have to focus on driving sales. Often improving a number of things a little better has more impact than making one large change.

Consider implementing the following tactics at the same time to achieve an accumulative effect on your profit.

The rule of 10%

If you can increase or decrease ten percent of your business that links to profit (or even five percent), then possibly customers will either not notice (unless you are in a very price sensitive market), or be fine with the changes.

Increase prices

Raising prices can lift your profit, but take care to check with your customers to see how they’d react to a price increase. If such a change lowers your demand and you lose customers, your profit margin may go up (as you’re charging more) but your overall profit may drop. To reduce a drop in sales while increasing prices try:

- Increasing prices on those items where customers are less price sensitive.

- Not increasing prices on items that you know customers compare with competitors.

- Gradually phasing in a price increase. To get to a 10% rise, you could try 1% each month for ten months.

Always monitor the effect of a price rise to detect any unhappy customers.

Increase revenue

A simple increase in sales (without discounting) should increase your profit. Some ideas to help you increase turnover include:

- Look to add new markets and distribution channels to your sales strategy. Identify any partners or ways to sell more.

- Use tactics that cost very little (if nothing) to increase sales such as asking for referrals, visiting existing customers, calling potential customers on their phone (yes, even in the digital age, selling on the phone can still work).

- See if there are any digital market places who will re-sell what you do.

- Form strategic alliances with complementary businesses or joint venture to tackle work you don’t have the resources to handle on your own.

- Maximize the value of your sales by moving upmarket and providing a premium product or service. Customers just may say yes when asked if they’d like the more expensive option. Add features if the perceived value to customers is greater than the cost to you.

- It could be possible to extend your product range by asking suppliers to provide you inventory and only pay for it when it’s sold. If you are the supplier and have excess stock, then you could do the same.

Reduce costs

Identify the steps you can take to minimize your direct costs, such as:

- Negotiating lower prices with your suppliers.

- Reviewing processes and systems to minimize waste.

- Implementing additional security to reduce the chance of theft.

- Make sure you get paid by putting systems in place to ensure that invoices are sent and paid promptly.

- Review fixed business costs such as insurance, power, and telecommunications and check if there are newer cheaper providers.

- Check any on-going subscription services (often via the internet) in case they are no longer being used, or you’re paying for more capacity than you need.

Categorize your customers

Divide your customers into four categories and put different effort and resources into selling to them depending on their value. For example customers that have a:

- High percentage of sales and high profit margins – nurture these customers and put most of your sales effort into them. Put in place customer loyalty programs so there is less chance they will get lured away by the competition.

- High percentage of sales but low profit margins – seek to raise the margin they return to you such as a price increase or examine how you can cut costs. It could be something simple like charging for freight when in the past it’s been free. Remember these customers are getting a good deal already.

- Low percentage of sales but high profit margins – consider a sales push to try and get them to buy more regularly, as for some reason they’re not buying as much as they could.

- Low percentage of sales and low profit margins – consider nurturing them to buy more or pay more, so you can move them up the profit scale.

Take into account any possible effects of increasing profits before making decisions. For example, a low-profit product might be the one that brings other business from a major, highly profitable customer.

Have staff focused on profitability

Focusing staff on profitability can have also a dramatic impact if they are aware that small savings can benefit everyone. Develop incentives if they assist with:

- Reducing power costs by switching off equipment or items that have a heavy power drain when not in use.

- Finding causes of waste and eliminating to increase overall margins.

- Referring and supporting new and existing profitable customers even if they are not in a sales role.

- Manage to exceed any sales targets.

- Sell items or services that have the highest margins while delivering a great customer experience.

Summary

Operating efficiently is essential to a sustainable, profitable business. From negotiating better terms with suppliers to nurturing your most profitable customers, your efforts can pay off.

Consider changing a number of things in your business all at once, to gain that cumulative effect on your profit.

Get started today for a more profitable bottom line.

Next steps

- Review every part of your business in detail to gain every cent of savings that you can.

- Find an external advisor to help you identify ways to build profit.

- Consider gathering like-minded small business owners to brain-storm ideas for building profits.

Get Started

Products Needed to Grow

BUSINESS LOAN CALCULATOR

Six Numbers to Measure Success

Back to Business Resource Center >

There are so many financial ratios and indicators that it can be a difficult to keep track of everything. Here are six important numbers to pay attention to when it comes to the success of your business, including ways you can improve them.

No. 1: Gross margin

Gross margin is the difference between what you pay for a product and what you sell it for. Look to improve your gross margin by considering:

- Increasing your prices. If it’s small enough, it may not cause too much disruption, but it may result in significant gain.

- Reducing cost of goods sold by using lower-cost materials where possible, without affecting quality. Research lower cost providers or ask your current supplier to renegotiate for your business at a lower price.

- Reducing waste. Examine any areas where there might be excess waste and devise ways to minimize. Recycle and reuse any materials you can.

No. 2: Average revenue per customer

The average revenue per customer is the total revenue divided by the total number of customers. Here’s ways to help increase this number:

- Predict customer needs by using your sales data to identify trends such as seasonal fluctuations and items frequently bought together, therefore helping you plan marketing promotions.

- Learn to up-sell and cross-sell.

- Make it easier for your staff by bundling products and services together.

- Target customers who you think have the most potential and develop a specific plan to sell more to each of them.

No. 3: Revenue growth

Steady, predictable revenue growth is the sign of a healthy company. Consider the following to further increase revenue:

- Generate more sales by selling more to existing customers. Set up a campaign to keep in touch with your existing customers.

- Look at developing new products or services for your existing customers.

- Create a marketing plan to identify, locate and sell to new customers.

- Look for new distribution channels to expand your customer base, including on your website and third-party ecommerce platforms.

- Consider exporting to gain new customers and increase revenue.

No. 4: Revenue per employee

Revenue per employee can be affected by several factors, including average revenue per user, better systems and processes, and automation. Here’s ideas to help increase revenue per employee:

- Set goals for your employees. Help them put a sales plan in place and measure their success.

- Incentivize your employees by providing either individual bonuses for sales achieved or run a combined sales revenue target (especially when you have employees in non-selling roles but they are still crucial to the business succeeding).

- Ensure your sales data is transparent so there is some measure for employees to track how they are doing. It doesn’t have to be sales information which may be confidential. It could be things they can easily see such as numbers of new customers, number of coffees sold per day, number of products finished and off the work floor.

No. 5: Net profit percentage

The net margin that accrues from all the effort of a business is the ultimate measure of how a company is being operated. Consider the following to increase net profit:

- Identify costs that occur each month on a subscription basis or are charged to you every month such as power, internet and phone. Look for ways to reduce these regular fees.

- If rent or lease payments comprise a large portion of your overhead, consider relocating all or some of your business to cheaper areas, especially if it’s not essential to your business, or customers don’t come to visit you directly.

- See if there are any costs you can share with other businesses: employees, marketing agencies, floor space, exhibiting or travel costs.

- Consider outsourcing any full-time tasks that you only need every now and then. For example, administrative tasks like payroll may not need a full-time (or part-time) person, and it could be cheaper to contract a specialist firm. See what else doesn’t require a full-time resource that would be overall cheaper to buy only when you need it.

No. 6: Net customer satisfaction

Track customer satisfaction by asking for opinions, feedback and ratings. This can give your business invaluable information about customer preferences, and what they like and don’t like. The higher the satisfaction of your customers, the more likely they are to come back again and again and refer your business to others.

Consider the following to help your customers spread good news about your business:

- Find out what people are saying about your competitors and use that information to improve the customer experience in your own business.

- Keep track of customer complaints. Document who the customer was, why they were unhappy and what was done to resolve it.

- Engage with customers on social media to measure their levels of satisfaction. You can talk to them directly, create customer surveys, and incentivize them to visit your website.

- Use email to send out customer satisfaction surveys. Incentivize them to participate in the survey by offering a discount or small gift.

Summary

Most businesses do not need a long list of ratios or numbers to track with spreadsheets, accounting software, applications, and dashboards sending unlimited streams of data to you each day. Instead establish a few numbers that mean something to your business, then set up a system so you can monitor what is happening to each of these every month.

If you can improve each one in small increments, you may see substantial improvements in profitability.

Next Steps

- Contact one of our Business Relationship Managers to see how we can help your Hawaii business grow.

- Set up monthly reporting so you can see if the numbers are improving each month. If not, take steps before the number further decrease.

- Talk to your accountant or financial adviser if there are other numbers you should measure and track.

Get Started

Business Products

Additional Resources

BUSINESS LOAN CALCULATOR

How to Value Your Business

Back to Business Resource Center >

If you’re selling your business, one of the main challenges is what you think the business is worth and what the person on the other side of the bargaining table thinks it is worth, are usually two different figures.

Deciding on a market value

Regardless of the method anyone uses to value a business, it’s simply a matter of finding someone who will pay what you’re asking. Theoretically if no-one wants your business then it’s worth nothing (apart from the second hand sale of any assets or inventory).

Past cash flow, profitability, and asset values are the starting points but it’s often the hard-to-measure factors such as key business relationships, reliable suppliers, loyal customers and goodwill that provide the most value.

To assist in this process it’s usual to arrange a business valuation with a business broker, accountant or valuation expert with experience in your industry.

Factors influencing value

Individual circumstances

Tangible assets

Intangible assets

Intellectual assets

Length of time

Agreements

Management stability

Valuation techniques

Remember, the true value of a business is always what someone is willing to pay for it. To arrive at this figure, buyers use various valuation methods, often to give a sense of reassurance that they are not paying too much. The main methods are as follows:

Asset valuations

Add up the assets of a business, subtract the liabilities, and you have an asset valuation – nice and simple. So if your business has $500,000 in machinery and equipment, and owes $50,000 on equipment finance, the asset value of the business is $450,000.

A buyer could decide to just buy the assets of a business rather than take over the business as a going concern. Take into account:

- Property or other fixed assets that may have changed in value. Just because an asset is ‘valued’ at a cost on the balance sheet, doesn’t mean that’s what you should sell it for.

- Assets that you’ve added value to, for example that have been installed, or improved. These may be worth more than just book value.

Entry cost valuation

An entry cost valuation reflects what it would cost someone to start the business from scratch, as it’s always an option for them. To make an entry cost valuation, calculate the cost of:

- Purchasing or financing assets and developing the products or services.

- Recruiting and training employees.

- Building up a customer base and generating repeat business.

- Knowledge of networks, suppliers, competitors and processes.

Industry rules of thumb

In some industry sectors, buying and selling businesses is common. This has led to industry-wide rules of thumb that are typically considered in valuing the business. These rules of thumb are dependent on factors other than profit. For example:

- Turnover for a computer maintenance business or monthly recurring revenue for a subscription business.

- Number of customers for a mobile phone airtime provider.

- Number of outlets for a real estate agency business.

- Net profit multiplied by an industry standard number.

Buyers will work out what the business is worth to them especially if they can merge your customer base with their existing business.

Next steps

- Determine which method of valuing your business creates the most value for you.

- Get expert advice as there are other valuation methods such as price earning ratios. Talk to your accountant, lawyer, a business broker, your banker or small business adviser about possible valuations of your business.

- Search online for similar businesses that are for sale to get a feel for the market of similar businesses for sale and what they were sold for. Remember that ultimately, your business is worth whatever someone will pay for it.