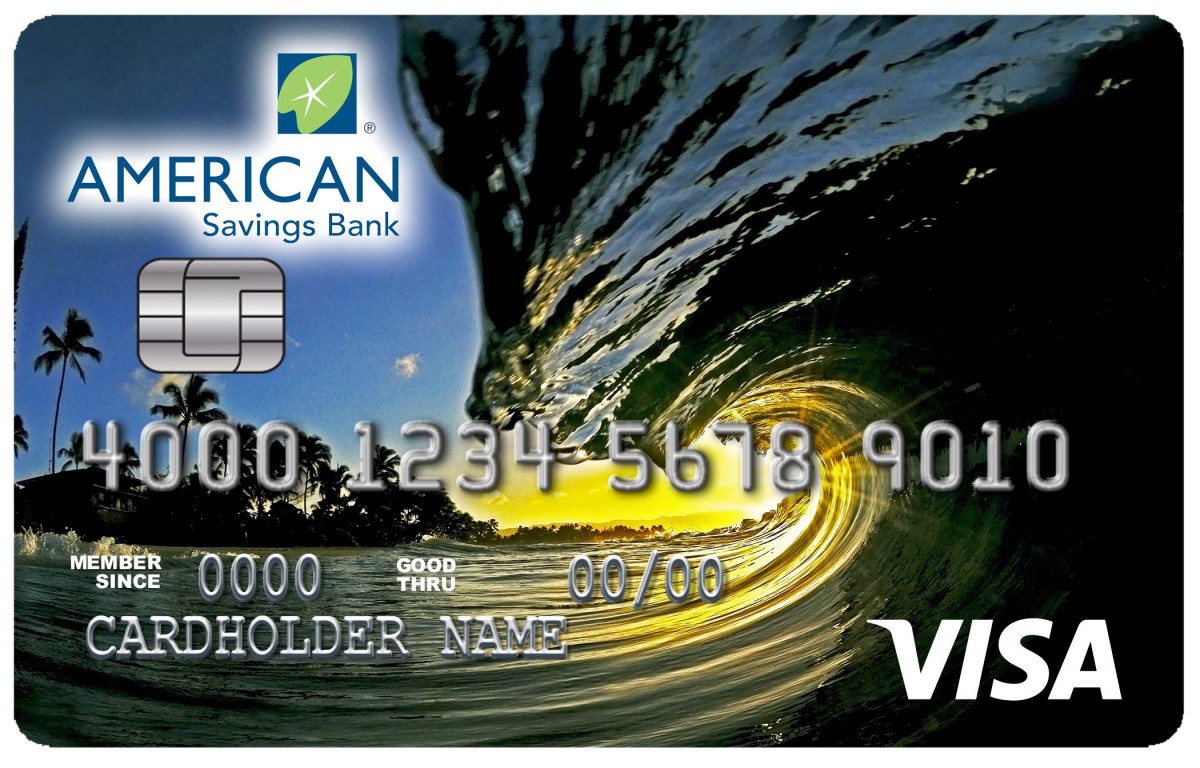

Maximum Rewards Visa Credit Card

Features:

- EARN 1.5% BACK ON PURCHASES2: Redeem rewards for cash back, gift cards, travel or merchandise.

- Use rewards for 5 years from when they are awarded before they expire.2

- No Annual Fee.1

- 0% introductory APR1 for the first 6 billing cycles after the account is opened on purchases and balance transfers. After that, a variable APR based on the Prime Rate between 18.24% and 28.24% APR depending on your creditworthiness.

- EMV chip included for added security.

Services:

- View and pay credit card bills online at www.firstbankcard.com/asbhawaii

- View FICO® Score each month online - for FREE! - Knowing your FICO® Credit Score can help you maintain and better understand your financial health.

- Apple Pay

Please see the Summary of Credit Terms for important information on rates, fees, costs, conditions and limitations. A balance transfer fee1 of 5% applies to each balance transfer you make (minimum $10). Minimum monthly payments required.

You must pay your entire statement balance (including all promotional purchase and balance transfer balances) by the due date each month to avoid being charged interest on new purchases from the date those purchases are made, unless your new purchases are subject to a 0% interest rate.

Common Questions:

For additional information on annual fees, please see the Summary of Credit Terms link for the product listed above.

A cardholder's credit limit is dependent on how the cardholder meets our credit criteria. If a cardholder has questions with the assigned credit limit they should contact Consumer Card Customer Care at (888) 295-5540 or Commercial Card Cardholder Support at (800) 819-4249.

If you lose your card, contact us immediately at (800) 444-6938. We'll block your account and issue you a replacement card. In an emergency situation, such as when you're traveling, we'll send you a temporary replacement card. If you have any further questions, please contact our Credit Card Customer Service at (888) 295-5540.

- For additional information about Annual Percentage Rates (APRs), fees and other costs, see Summary of Credit Terms.

- See the Rewards Terms and Conditions in the Summary of Credit Terms for details, including earning, redemption, expiration, or forfeiture. Your % back rewards are earned as points.

Cards are issued by First Bankcard®, a division of First National Bank of Omaha, pursuant to a license from Visa U.S.A. Inc. Visa and Visa Signature are registered trademarks of Visa International Service Association and used under license.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Please note that new cardmembers will generally see their FICO® Bankcard Score 9 (the version of FICO® Credit Score we use to manage the account) within 45 days of account opening.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.