Compare Savings Accounts

Begin saving with as little as $100 - we're with you and your business for the long haul

Begin saving with as little as $100 - we're with you and your business for the long haul

Select a category below to compare:

Ready to take the next step?FIND A BUSINESS BANKER

As your business starts to grow, upgrade your checking account to receive more benefits

Tap your ASB Visa® Business Debit Card or connect it to your smartphone

For businesses with high-volume transactions and advanced cash management needs, see what we have to offer with Analyzed Checking.

Select a category below to compare:

Ready to take the next step?FIND A BUSINESS BANKER

Have peace of mind for retirement planning and see if a Traditional or Roth IRA is right for you

Select a category below to compare:

Ready to take the next step?ACCESS ACCOUNT

Bank IRAs:

Offered through American Savings Bank

FDIC-insured accounts

Fixed CD term or Savings available

Available through branches

Brokerage IRAs†:

Offered through American Savings Investment Services

May invest in stock, bonds, mutual funds and annuities

Tailored to your investment strategy

Not FDIC insured

† Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investments are offered. Advisory services are only offered by Investment Adviser Representatives. Registered address and phone number: American Savings Investment Services, 300 North Beretania Street Honolulu, HI 96817. (808) 735-1717.

Click to view Cetera Investment Services Privacy Policy and other Important Information.

This site is published for residents of the United States only. Registered Representatives of Cetera Investment Services LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every advisor listed. For additional information please contact the advisor(s) listed on the site, visit the Cetera Investment Services LLC site at www.ceterainvestmentservices.com.

Finance your next milestone whether that's paying for tuition, consolidating debt or somewhere in between

Download Personal Lines and Loans Application | Consumer Loan Fee Schedule

Download HELOC Application

Select a category below to compare:

$500 to $15,000

Save for your next chapter with the account designed for wherever life takes you

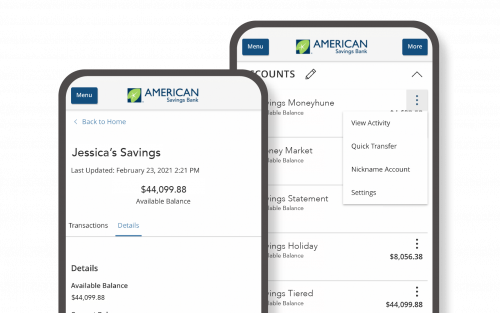

Bank Anytime, Anywhere with the ASB Hawaii Mobile App

Select a category below to compare:

Ready to take the next step?OPEN AN ACCOUNT

As your life starts to change and your account begins to grow, upgrade to receive even bigger benefits

Tap your contactless ASB Visa® Debit Card or connect it to your smartphone and pay while on-the-go

Score $20 cash back!*

Open a joint checking account with your teens and they'll get rewarded when they use their ASB Visa® Debit Card.

Not sure where to start? Use our Checking account chooser tool.

Select a category below to compare:

Ready to take the next step?OPEN AN ACCOUNT

The COVID-19 pandemic has made many unforeseen impacts on the United States economy, from nationwide unemployment to the affects it has had on travel and tourism. Everyone from news reporters and politicians to business owners and family members seem to be talking about the current economy.

At American Savings Bank, we want to remind you that you’re not alone if you’re feeling confused or overwhelmed by global and national finances. In this post, we share some of the most frequently asked questions we’ve received in recent months.

What do you think of when you hear “the economy”? For many, they picture a room full of arguing politicians or number-crunching economists. The basic definition of the economy includes all of the activities in producing, distributing, and consuming goods or services in a certain area. A good or service is produced and exchanged to a consumer for something of value, such as money.

The United States mostly operates on a market economy, meaning people and businesses are free to exchange their goods or services with one another. For example, you build a birdhouse and sell it to your neighbor. Supply and demand play a large role in a market economy. Let’s say you build a second birdhouse, but now three neighbors want to buy it. You have a lower supply and higher demand, allowing you to charge a higher price. Likewise, you might start producing more birdhouses to meet the new interest in your product.

Although a free market is the main economic system in the U.S., regulations, programs, and restrictions exist. These guidelines are designed to help protect the well-being of everyone in the country. Public schools, for example, are provided by the government to help keep access to education more balanced.

The most common measurement of the economy is the gross domestic product (GDP). The GDP is the total value of every good and service produced in a community in a year. Economists regularly use GDP growth — how much the GDP has gone up or down over a period of time — to gauge the health of the economy.

A good economy, in general, is one with a growing GDP. This often leads to more businesses, more production, and more jobs. A bad economy, on the other hand, usually means the GDP growth is negative or trending downward from the previous time frame.

The effectiveness of using GDP growth to measure economic health has recently become a debate. Some economists believe the GDP doesn’t provide enough insight into the overall well-being of people within an economy.

A recession is a financial crisis that occurs due to a steep decline in economic activity. Most recessions lead to higher unemployment, lower production, and a declining GDP. The National Bureau of Economic Research (NBER) is often the authority on declaring a recession in the US.

According to the NBER, a recession occurs when there’s a significant decline in economic activity throughout an economy that lasts more than a few months.

An economic depression is similar to a recession but does more long-term damage: more jobs are lost, there’s a higher unemployment rate, and production slows down significantly. Unlike a recession, economic recovery from a depression is usually much longer. Most depressions last for years instead of months.

While the stock market and economy are related, they are two different entities.

The economy consists of the production of goods and services in exchange for money. It’s measured by the growth or decline of production and employment. The stock market is a marketplace to buy and sell the ownership of businesses in the form of stocks, mutual funds, and other investment assets.

The economy can be hurting while the stock market surges. The economy includes all businesses — both private and public. The stock market only includes publicly-traded entities. Private businesses, especially small businesses, have been heavily affected by the COVID-19 pandemic. Meanwhile, some large, public corporations are seeing increased demand for products. Since private companies aren’t part of the stock market, financial declines among private companies are not represented in the stock market.

The COVID-19 virus has led to a decrease in demand for some products and services. Many communities were put on lockdown for weeks or even months, which resulted in almost no demand for the travel, hospitality and entertainment businesses. Decreased demand also spread through other industries, as fewer people had income for products due to being furloughed or let go from their jobs. Others no longer needed goods or services because they were staying home and only purchasing necessities.

Even with some communities reopening, many businesses are operating at reduced capacity. Many people who lost jobs or had their hours cut have still not fully replaced their income. Public health officials still recommend that people stay home and avoid being in public as much as possible, meaning fewer people are visiting businesses.

These factors have led to lower production, higher unemployment, and less exchange of money in recent months — all indicators of economic health. Since almost every measure of the economy went down, the overall economic well-being decreased as well.

The biggest differences between the 2020 economic crisis and the Great Recession of 2008 are the contributing factors and the speed of the economic decline.

In 2008, the financial crisis happened due to the burst of the housing market bubble. Some mortgage lenders had widespread approval of unqualified borrowers, which meant that homebuyers were given a loan they couldn’t afford, resulting in financial imbalance. As a result, the economy steadily declined over several years.

In 2020, the economic downturn was being fueled by the contagious nature of the COVID-19 virus. People have been doing their best to avoid spreading and contracting the virus, which often resulted in more individuals staying at home and putting less money into the economy. The rapid response to slow the spread of the virus led to a quick, almost immediate decline in the economy.

A bank is one of the safest places for your money during a financial crisis. Thanks to the Federal Deposit Insurance Corporation (FDIC), bank deposits are insured up to a certain amount. Rather than putting cash under your mattress, consider putting your money into a checking or savings account at a bank where it can stay safe.

Banks are expected to play a central role in the economic recovery of any economic crisis. Due to the pandemic, many banks such as American Savings Bank are offering programs to customers who are out of work and/or facing financial hardships. In addition, banks can help to facilitate federal and state programs such as the Paycheck Protection Program. These programs can give customers the relief they need to find new work, keep their business running or replace decreased income.

For example, by providing options like loan deferment — which allows a borrower to temporarily pause loan payments — banks like ASB are giving customers a chance to get back on their feet.

If you are facing financial hardships due to the pandemic, be sure to explore our hardship programs. Our team is here to help you navigate your options during these difficult times.

If you’re fortunate enough to be in a secure financial situation during an economic downturn, spending money in your community can help local businesses and workers. While you can’t single-handedly fix a hurting economy, you can potentially help your most vulnerable neighbors.

Small businesses and lower-wage workers are among the most likely to suffer from an economic downturn, so consider spending money by:

Buying from local small businesses, like your corner market or favorite family-owned restaurant

Purchasing gift cards from local businesses

Donating to local food banks, shelters, and community organizations

Tipping delivery drivers, servers, and other service workers generously

This month, American Savings Bank was officially certified a Great Place to Work®, a designation awarded to the top companies around the world.

ASB joins an elite group of certified companies globally that have worked hard to create an excellent workplace culture for its teammates. The certification process includes a company-wide survey and written nomination. Highlights from the survey results include:

90% of teammates say ASB is a great place to work (compared to 59% at a typical U.S.-based company)

94% of teammates say that when you join ASB, you are made to feel welcome

94% of teammates feel they are treated fairly, regardless of their gender

95% of teammates feel good about the ways ASB contributes to the community

“We’re proud to renew our Great Place to Work® Certification, a recognition that validates our commitment to providing a top-notch teammate experience at ASB,” said Rich Wacker, President and CEO of American Savings Bank. “This means so much to us, especially after a challenging year like 2020. We owe this recognition to our outstanding teammates who work hard, each and every day, to make dreams possible for our customers.”

ASB has garnered both local and national awards for its unstuffy and teammate-focused culture, tremendous growth opportunities and one of the best benefits packages in the state – including weekly paydays, a casual dress code, generous Paid Time Off program, pet insurance and more. It has been named one of the “Best Places to Work in Hawaii” by Hawaii Business magazine for 12 consecutive years and honored nationally as one of the “Best Banks to Work For” by American Banker magazine. Fortune magazine has also recognized ASB as one of the 100 Best Workplaces for Women and 50 Best Workplaces for Diversity.

Great Place to Work® is the global authority on workplace culture, employee experience, and the leadership behaviors proven to deliver market-leading revenue, employee retention and increased innovation.

“Great Place to Work Certification™ isn’t something that comes easily – it takes ongoing dedication to the employee experience,” said Sarah Lewis-Kulin, vice president of global recognition at Great Place to Work. “It’s the only official recognition determined by employees’ real-time reports of their company culture. Earning this designation means that American Savings Bank is one of the best companies to work for in the country.”

According to Great Place to Work research, job seekers are 4.5 times more likely to find a great boss at a Certified great workplace. Additionally, employees at Certified workplaces are 93% more likely to look forward to coming to work, and are twice as likely to be paid fairly, earn a fair share of the company’s profits and have a fair chance at promotion.

About Great Place to Work CertificationTM

Great Place to Work® Certification™ is the most definitive “employer-of-choice” recognition that companies aspire to achieve. It is the only recognition based entirely on what employees report about their workplace experience – specifically, how consistently they experience a high-trust workplace. Great Place to Work Certification is recognized worldwide by employees and employers alike and is the global benchmark for identifying and recognizing outstanding employee experience. Every year, more than 10,000 companies across 60 countries apply to get Great Place to Work-Certified.

About Great Place to Work®

Great Place to Work® is the global authority on workplace culture. Since 1992, they have surveyed more than 100 million employees worldwide and used those deep insights to define what makes a great workplace: trust. Their employee survey platform empowers leaders with the feedback, real-time reporting and insights they need to make data-driven people decisions. Everything they do is driven by the mission to build a better world by helping every organization become a great place to work For AllTM.

Learn more at greatplacetowork.com and on LinkedIn, Twitter, Facebook and Instagram.

Karwin Sui

Communications Manager

(808) 539-7268

ksui@asbhawaii.com

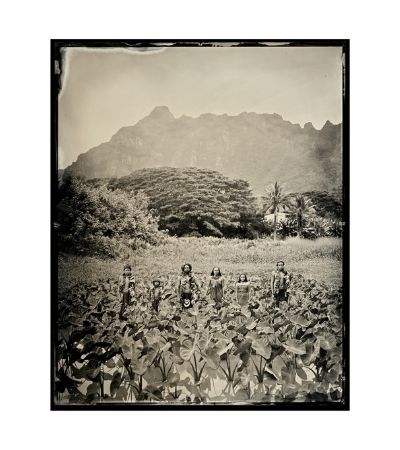

After a brief hiatus, ASB’s Lo‘i Gallery is back with three talented local artists, each representing a unique medium inspired by the people and nature of Hawai‘i.

The works of Roen Hufford, Kenyatta Kelechi and John Tanji Koga are on display at the Lo‘i Gallery, located at the ASB Campus, through Jun. 30, 2021. 20% of sales from the gallery will benefit one of ASB’s Kahiau Partners, which include Child & Family Service, Kapiolani Health Foundation, Kupu, Partners in Development Foundation and United Way. Each artist will select one of the nonprofits to donate to for each sale.

Hufford’s work includes a collection of kapa pieces that pay tribute to the ancient art. A lifelong student of her mother, kapa maker Marie McDonald, Hufford began beating kapa in 2000 has since had her work shown throughout the state of Hawaii at Hoea Gallery, Bishop Museum, Maui Arts and Cultural Center, Merriman’s Restaurant in Waimea, the Kahilu Theater and more.

Invented in Europe in the mid-1800s, wet-plate photography was brought to Hawai‘i by Western photographers to document and share what they saw. Kenyatta Kelechi specializes in this tedious, archaic method that involves a harmony of chemicals and timing in capturing his subjects. His pieces include prints from a collection titled “Manachrome” – a series of portraits of Native Hawaiian practitioners.

Koga is a modernist sculptor and painter whose works are part of museum, corporate, public, and private collections around the world. His works include abstract and semi-abstract sculptures and paintings inspired by the ocean and mountains of Hawai‘i, as well as the fellow artists included in the current gallery rotation. Koga is an active participant in promoting the arts in Hawai‘i.

View all of the gallery works and contact an artist to purchase a piece at asbhawaii.com/loigallery.

The land upon which the ASB Campus sits – and its surrounding areas – was once filled with lush loʻi kalo (taro patches), nourished by the Nuuanu Stream, which flows alongside. Just as the loʻi nurtures the kalo within, ASB’s Loʻi Gallery provides a space for artists of Hawaii to share their talents with the community.

As part of ASB’s commitment to bringing real impact to the community, 20% of sales will benefit a local nonprofit selected by ASB. Remaining proceeds will go directly to the artists, further supporting Hawaii’s local art community.

Beneficiary: Council for Native Hawaiian Advancement

See below for featured artists. For purchases and inquiries, please contact the artist directly.

Want to showcase your art in our Loʻi Gallery? Apply here.

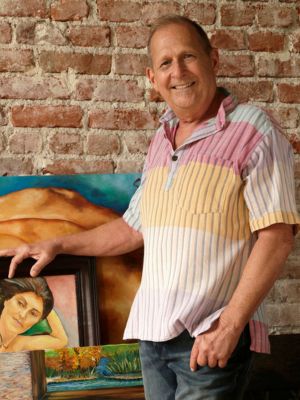

George Evan Davis has lived the life of a young starving artist, had two successful careers and is now retired. He has returned full circle to his art roots. George uses oils, acrylics and mixed media to create art ranging from the realistic to the unconventional. His style varies depending on the subject. He loves the delicacy and focus that comes with capturing the essence of a figure on canvas. His abstract artwork allows him to make a statement and create unique pieces.

Residing on the North Shore of Oahu since 2008, Steven Kean is an accomplished artist and art educator specializing in woodcut prints. His work is driven by a deep passion for both the artistic process and the ocean, which serves as a constant source of inspiration.

Kean’s art has been showcased internationally, throughout the Hawaiian Islands, and across the continental United States. He has been involved in several high-profile commissioned projects with brands such as Google, Starbucks, Four Seasons, Vans, Olukai, Kahala MKT by Foodland Hawaii and Hawaii Tourism Japan.

Sasha Lynn Roberts, a Brooklyn-born artist in Haleiwa, Hawaii, explores nature and the human form through vibrant, surreal compositions. Blending digital illustrations with acrylic painting, her work celebrates resilience, space and identity in nature. A prodigious talent, her artwork appeared in the Metropolitan Museum of Art at age 13. She later studied at New York University Tisch School of the Arts and Hunter College, earning her degree at 19. Her art has been exhibited globally, including at the MET, Rockefeller Center, Hawaii’s Downtown Art Center and Miami Art Basel.

Hawaii artists may apply to have their artwork featured in the ASB Loʻi Gallery for four months. Selected artists will receive a stipend of $500 at the end of the showing and must donate 20% of proceeds to the designated nonprofit beneficiary for the rotation. Additional terms will be provided to selected artists. ASB will host a reception, where artists may invite their friends and family to join the festivities and invited guests receive an exclusive opportunity to view and purchase artwork unique to the gallery before it opens to the public.

Loʻi Gallery artwork must be:

Loʻi Gallery artwork must not be: